02/07/2021 - Market news

Deal volume increases by 7% at Clearwater International despite a challenging year

Download our Financial Year Review

Leading mid-market advisory firm Clearwater International has commenced the 2021/22 financial year with a strong dealflow completing 45 deals worth over €2bn in deal value in the first quarter of the financial year.

completed 138 deals placing Clearwater International in 9th place in the pan-European financial advisors league table

Looking back at the previous period, 2020/21 was a turbulent year for global markets following the outbreak of the COVID-19 pandemic, with the M&A market taking an immediate hit. However, Clearwater International continued to support their clients and team throughout these unprecedented times and completed the year with a 7% increase in deal volume.

During the last financial year, Clearwater International completed 138 deals placing the independent corporate finance house in 9th place in the pan-European financial advisors league table. The business achieved revenues of over €73m representing a small decline in fee income of just 1% compared to the previous financial year (2019/20), demonstrating a sustained performance under unprecedented circumstances.

Clearwater’s work with private equity (PE) has continued to grow, with 67% of transactions involving PE funds during the year, representing a 48% increase in PE activity. Notable key deals included: the UK team advising WJ Group, the UK’s leading supplier of award-winning road markings and specialist highway products and services, on receiving a majority investment from THI Investments, advising LDC and management on the sale of specialist manufacturer ChargePoint Technology to Arcline Investment Management and advising LeMieux, a leading equestrian brand on its minority investment from mid-market private equity firm LDC to accelerate international growth and expand its product range.

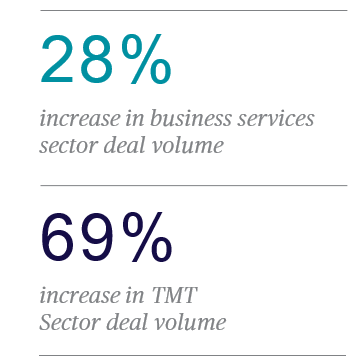

Significant growth was seen across the business services and TMT sectors, closely followed by the consumer and industrials & chemicals sectors.

With over 54 completed transactions, the European Debt Advisory team raised €1.7bn in debt finance. This debt was utilised by European businesses to support acquisition activity, refinance existing debt facilities, re-align capital structures, and support organic growth. The team provided support across the spectrum of sectors however, work within the business services, healthcare, TMT and certain areas of the consumer sectors made up 65% of activity during the year as these sectors proved to be attractive to lenders. Among the key deals for the team the UK team advised community pharmacy and distribution business Day Lewis Plc on a refinancing to provide a €146m (£125m) revolving credit facility.

Significant growth was seen across the business services and TMT sectors, closely followed by the consumer and industrials & chemicals sectors.

The TMT team experienced an exceptional year with a 69% increase in deal volume and a 78% increase in total deal value across the sector compared to the previous year.

Key deals to note included the UK team advising Infinity Works, one of the UK’s leading digital transformation consultants, on its sale to global professional service company Accenture which marked an exit for investors Growth Capital Partners and advising Hippo Digital, a design-focused digital transformation consultancy on its minority investment from Growth Capital Partners.

Deal volume also grew by 28% in the Business Services team with a 72% increase in the total deal value during the year. Key deals for the team included: the UK team advising LDC on the merger of Lomond Capital and Linley & Simpson in a €109.3m transaction, to create a new national lettings and estate agency group and advising Ellis Whittam an employment law, HR and health safety provider on its sale to Marlowe Plc, which marked an exit for its founder Mark Ellis and minority shareholder LDC

Clearwater International continued to expand the international footprint throughout the 2020/21 financial year. In June 2020, Clearwater International announced its strategic alliance with KeyBanc Capital Markets Inc. (KBCM), the corporate and investment banking arm of Cleveland-based KeyCorp (NYSE:KEY). This alliance solidified a multi-year effort to enhance collaboration on cross-border M&A transactions. KBCM brings more than 800 professionals across a national platform in six major industry sectors—including healthcare through the acquisition of Cain Brothers—to Clearwater’s global client base.

Clearwater International also continued its growth in Europe with the merger of Sweden-based Valentum in September 2020. Based in Stockholm, the established team of 18 dealmakers bought the international footprint to 18 offices in 10 countries across Europe, Asia and North America. In March 2021, Clearwater International announced a strategic alliance with Marseille-based, Blue Side. In the last five years, the Blue Side team, comprising of six professionals, has completed more than 40 transactions in France and abroad, with regional SMEs valued from €7m to €100m.

Despite 2020 being a challenging year, Clearwater International strengthened its international team with the onboarding of the team in Sweden and 46 new hires across Europe. A number of new senior appointments were made, including the hire of two new TMT partners, Nathaniel Cooper in the UK and Jeremy Sartre as Managing Director, France. Career progression remained a key priority during the last financial year, with 20% of the team being promoted including five promotions to Partner; Joe Dyke and Wesley Fell-Smith in the UK team, Julien Choppin and Jonathan Bursztyn in the French team and Jesper Agerholm in the Danish team. Clearwater is committed to increasing diversity across the workforce and this year made headway with 23% of junior hires being female.

Michael Reeves, CEO, Clearwater International, said:

“The decision from World Health Organization to declare the COVID-19 outbreak a pandemic in March 2020 was a significant moment and will remain a reference point in history as the effects continue to unravel. Whilst a number of transactions were put on pause, our team pivoted and adapted to continue to support our clients, especially through the initial period where stability was at the forefront of everyone’s minds.

I have been delighted by the speed the team have adjusted to the new ways of working under new guidelines. I want to thank all of our people for their hard work this year.

The team have showcased our values as a business throughout this period of uncertainty, remaining personable, adaptable and committed to both the business and our clients.

Clearwater International has remained on its growth trajectory and has kept a strong foothold in the market experiencing growth across sectors and service lines this year which was certainly tough to imagine back in March. Already a few months in, I am confident that this financial year looks set to be a monumental year for the business with some significant developments already in motion.”