Pharmaceutical outsourcing

Market drivers

Large pharma companies are under pressure from investors due to rising competition from generics and eroding top-line figures. Over the past year some 60% of deals in the pharma segment have been focused on boosting drug pipelines of large pharma companies.

Pharma and biotech companies are shifting their R&D focus to niche drugs based on personalised therapies.

Particular segments are seeing very strong dealflow, such as the recent consolidation within the outsourcing services market. Major CRO (Contract Research Organisation) players have started to outsource some services such as their patient recruitment services.

Future-proofing clinical trials will bring drugs to market faster, by the convergence of real-world evidence (RWE) and clinical data. RWE will help with early pricing strategy and designing the Phase III trial, as well as determine product positioning and shape the market. We will continue to see RWE interest from CROs.

Investment thesis

To recover loss in revenue due to patent expiry of blockbuster drugs, large pharma companies are acquiring companies with promising drug pipelines. Trade buyers remain the most active buyers with a lot of cash to invest.

With more generics entering the market, and consolidation of drug distribution channels, the generics sector is impacted by pricing pressure. To protect profits many businesses are consolidating to add scale, and reach and achieve cost savings.

Increasing R&D expenditure is driving the global CRO market which is expected to reach £40.7bn by 2023, a rise from £28.3bn in 2018, demonstrating a CAGR of 7.6%1.

Despite the expected market growth, it has been suggested that the CRO industry may be starting to mature, driven by slowing revenue growth, a reduction in the number of CRO businesses, and fewer new customers to the market. However many smaller CRO’s which are more nimble, are concentrating on seeking small to medium-sized biopharma customers, focussed on biological and rare disease based molecules.

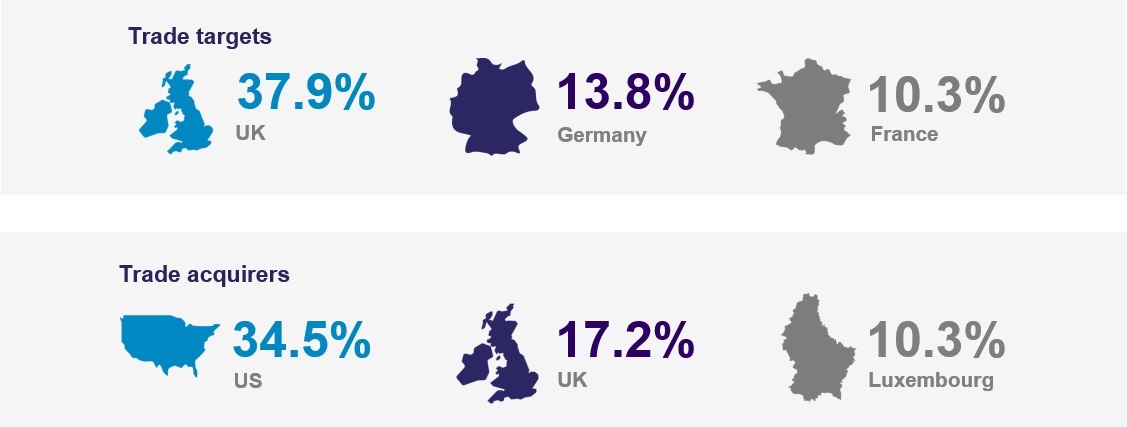

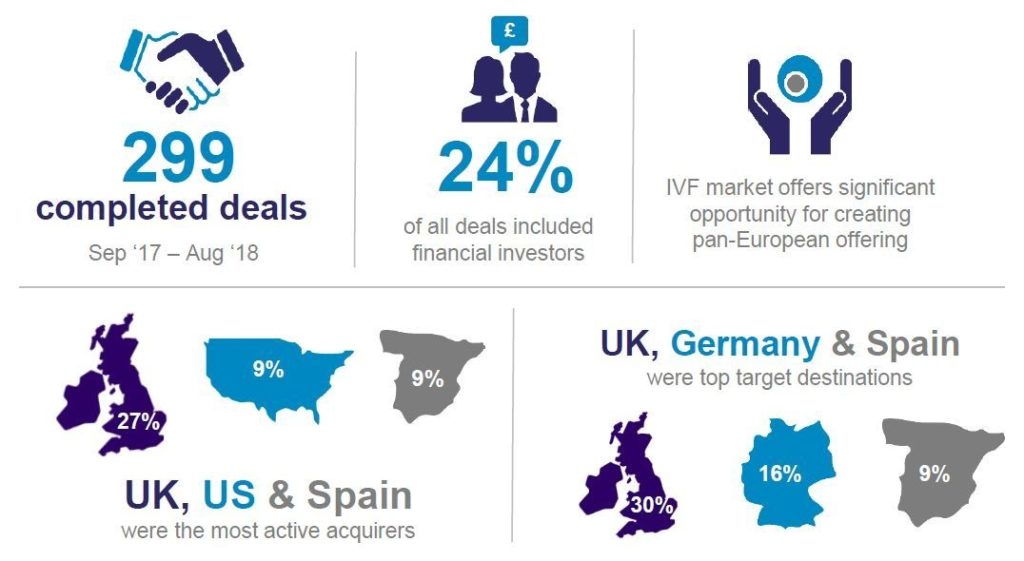

Trade activity

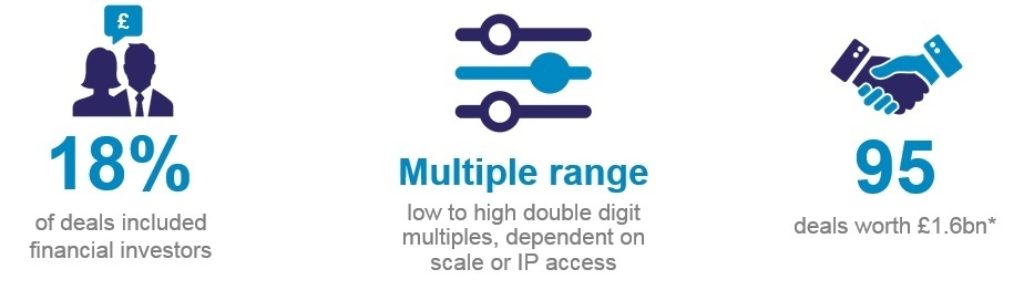

- Covance (US) acquired Chiltern International (UK) - LabCorp® is a leading US life sciences company and Chiltern now becomes part of the company’s Covance drug development business. The acquisition creates a market-leading CRO, with more than 20,000 employees around the world.

EV: £910.5m, EBITDA: 12.6x - Spectris (UK) acquired Concept Life Sciences (UK) - Concept Life Sciences, a drug discovery, development and analytical services company, was acquired by instrumentation and controls business Spectris.

EV: £163m, EBITDA: 17.5x - Eurofins Scientific (Luxembourg) acquired Amatsigroup (France) - Eurofins Scientific is a leader in bio-pharmaceutical products testing and genomic services, and Amatsigroup is a leading international contract development and manufacturing organisation (CDMO) providing pre-clinical and clinical phase services for the development of drugs.

EV: £150.3m, EBITDA: n.a

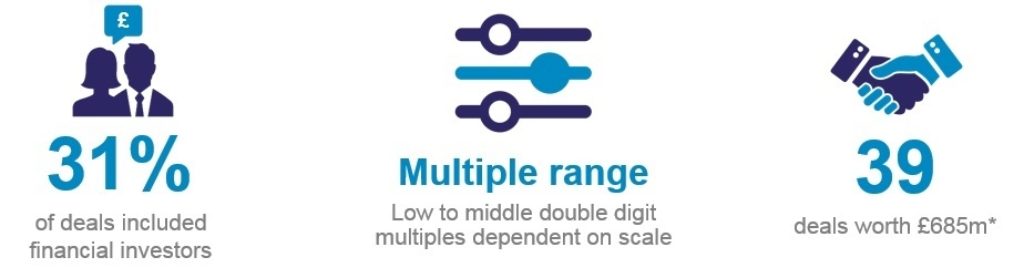

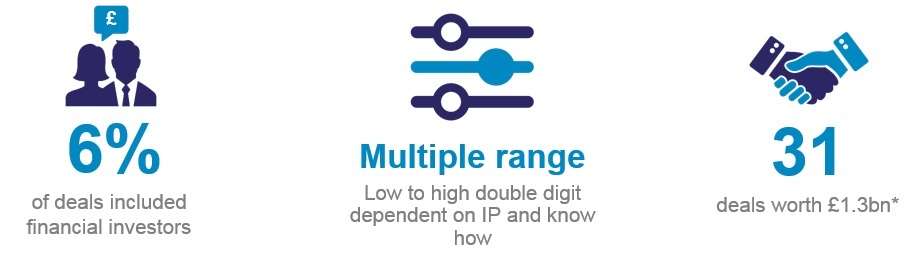

Financial investor activity

- Pamplona Capital Management (UK) acquired PAREXEL International Corporation (US) - PAREXEL is a biopharmaceutical outsourcing services company providing clinical research services. Pamplona Capital Management is a UK based investment firm.

EV: £4.2bn, EBITDA: 14.6x - Phoenix / SygnatureEquity Partners (UK) acquired Sygnature Discovery Limited (UK) - Phoenix Equity Partners is a private equity firm based in the UK which invests primarily in private medium sized UK companies. Sygnature Discovery Limited is a UK based provider of integrated drug discovery services. The investment from Phoenix will enable the company to continue on its growth and development strategy.

Sponsor backed platforms to note:

- Sponsor: LDC

Company: Fishawack

Country: UK

Revenue: £35.3m

EBITDA: £3.8m

Date invested: Jan 2017 - Sponsor: AUCTUS Capital Partners

Company: Pharmalex

Country: Germany

Revenue: £27.8m

EBITDA: £4m

Date invested: Oct 2015 - Sponsor: Deutsche Private Equity

Company: PharmaZell GmbH

Country: Germany

Revenue: £75.4m

EBITDA: n.a.

Date invested: Dec 2013