Medical equipment and supplies

Market drivers

Leading players are turning to consolidation to access technology and global markets in order to maintain their competitive edge.

Driven by the ageing demographic, there remains a huge drive to develop devices that can help both treat age-related conditions and manage chronic diseases.

For instance, the increasing use of robotics in surgery allows doctors to perform many types of complex procedures with more precision and flexibility, whilst 3D printing allows for more bespoke prosthetics. It is hoped the mass adoption of these technologies will help bring down the cost.

Investment thesis

The German market, the third largest in the world behind the US and Japan, is particularly attractive to investors with a strong export base. In 2016, around 70% of German medical device revenues came from exports and made up c.12% of the world’s total medical device exports.

We expect to see high and rising R&D expenditure in orthopaedics, cardiology, endoscopy and diabetes.

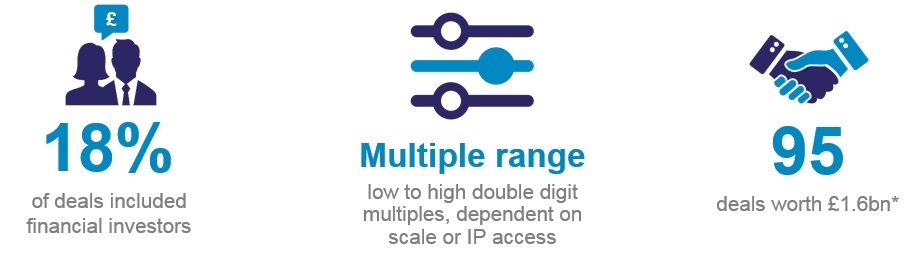

Trade activity

- Ambu (Denmark) acquired Invendo Medical (Germany) - With this acquisition Ambu enters the field of gastrointestinal endoscopy (visualisation of the stomach and intestines) of which there are approximately 70 million procedures annually.

EV: £200.4m, EBITDA: n.a - Gerresheimer AG (Germany) acquired Sensile Medical AG (Switzerland) - Gerresheimer AG provide plastic and glass products to the healthcare industry. Its products include packaging and drug delivery devices, such as inhalers, syringes and injection devices. Sensile Medical AG provides a range of drug delivery and dosage products to the medical market.

EV: £309.9m, EBITDA: n.a - CyroLife (US) acquired JOTEC (Germany) - CryoLife is a leading medical device and tissue processing company focused on cardiac and vascular surgery, while JOTEC develops endovascular stent grafts, and cardiac and vascular surgical grafts focused on aortic repair. The deal creates a company with a broad product portfolio focused on aortic surgery, and will position CryoLife to compete strongly in the important and growing endovascular surgical markets.

EV: £192.1m, EBITDA: n.a

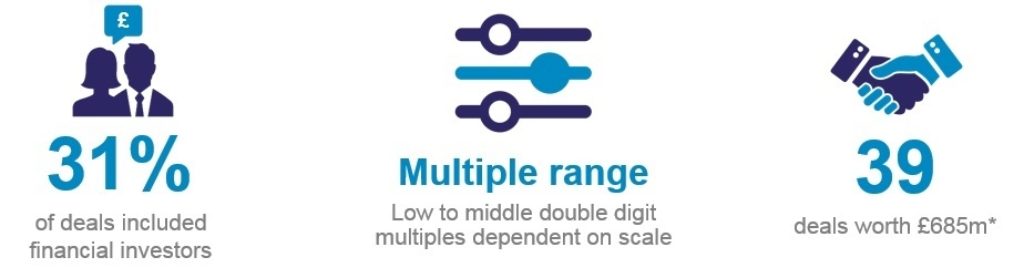

Financial investor activity

- GIMV and Mérieux Développement (Belgium) acquired Stiplastics (France) and Arseus Medical (Belgium) - Stiplastics is a specialist in treatment observance, and its range of ‘intelligent’ pill dispensers make administering and taking medicines easier and safer. The deal allows Stiplastics to continue its development in new territories and products. Clearwater International advised GIMV and Mérieux Développement on the acquisition.

EV: n.a, EBITDA: n.a - Axcel Management A/S (Denmark) acquired Orion Diagnostica Oy (Finland) - Orion Diagnostica Oy manufacture diagnostic tests and test systems, and have operational locations across Europe.

EV: £195.1m, EBITDA: n.a - Nazca Capital SGEIC SA (Spain) acquired Phibo Dental Solutions SL (Spain) - Spain based private equity firm Nazca Capital typically invest between €10m and €35m, and tends to invest in underperforming or operationally distressed businesses. Phibo Dental Solutions manufactures and supplies dental products such as implants and prosthetics.

EV: £10.5m, EBITDA: n.a

Sponsor backed platforms to note:

- Sponsor: Duke Street

Company: Medi-Globe

Country: Germany

Revenue: c. £100m

EBITDA: £15m

Invested: Mar 2016 - Sponsor: Kester Capital

Company: Frontier Medical Limited

Country: UK

Revenue: £34.1m

EBITDA: £9.5m

Invested: Dec 2013 - Sponsor: PAI Partners

Company: Atos Medical AB

Country: Sweden

Revenue: £53.8m

EBITDA: £27.8m

Invested: May 2016