M&A activity and market drivers

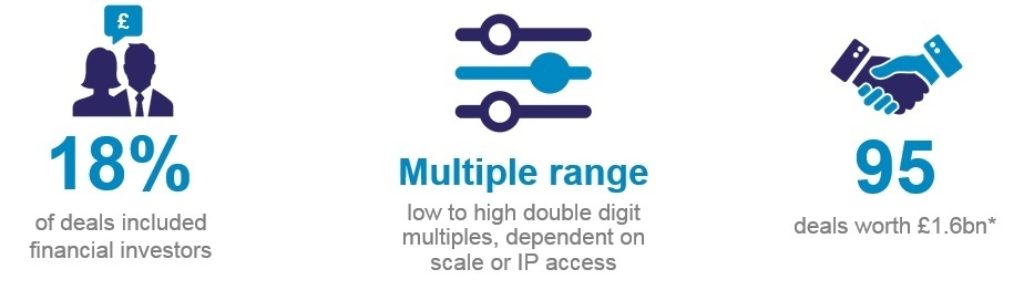

The M&A market in healthcare across Europe remains extremely vibrant, with global investors attracted by well-entrenched multiples and the potential to create pan-European offerings in specific sectors.

The medical equipment and supplies market continues to lead the way. Recent transactions have seen Nordson Medical Corporation, a US- based manufacturer of non-wovens, incontinence and disposable products, acquire Clada Medical Devices, an Ireland-based balloon catheter manufacturer. And French private equity firm Platina Equity Solutions acquired Cap Vital Santé, a French company producing durable devices for the elderly.

The European healthcare assets market has been particularly attractive to overseas investors, and the trend has continued throughout 2018.

A recent deal saw Belgium investment firm Confinimmo SA acquire 14 nursing home operators in Germany. Another recent transaction was Primonial Group acquiring a 50% interest in a real estate portfolio in Germany for £1.46bn, a deal which Clearwater International advised on. In the past weeks we have also seen iCON Infrastructure acquire Choice Care Group, the UK provider of specialist care for £153m.

The dental and veterinary services markets are seen as ripe for further consolidation. One of the most active investors in the veterinary market has been UK firm CVS Group and in recent weeks it has made several acquisitions across Europe, including the Netherlands, Ireland and the UK. In the dental market a recent deal saw UK firm BUPA acquire six dental care service providers in the UK.

Meanwhile the pharma outsourcing market has remained buoyant in recent times, typified by the acquisition of UK company Kinapse Ltd by global leader Syneos Health Inc of the US.

We expect to see further consolidation in the untapped areas of IVF, foster care and nursery services across Europe and particularly in the UK, as recently demonstrated by CapVest investing in Core Assets Group in October.

These markets are fragmented and require an investor or trade player to create or use an existing platform to buy and build a sizeable opportunity.

Market drivers

Ageing population and demand for chronic care

Governments across Europe are grappling with growing demand for healthcare services due to ageing societies and increasingly complex care needs. The ageing population is increasing the prevalence of chronic conditions such as cancer, diabetes, cardiovascular, neurovascular and respiratory disease, as well as increasing demand for non-urgent operations such as hip and knee replacements.

There is also a greater role for private sector healthcare provision with the trend of patients increasingly opting for private provision showing no signs of slowing.

The ageing population also drives a shift towards people being cared for in the community, rather than in residential care homes. In the UK Helping Hands, a private pay live-in-care provider, recently received investment from Livingbridge acquiring a 30% stake in the homecare provider, a sign of the future travel of home care.

Despite this, the care homes market has continued to see growth because of the sheer scale of the rise in the ageing population and previous under provision of beds in key European countries.

Rising cost pressures

Many European governments are witnessing downward funding pressure on social care budgets. Yet at the same time the number of hours of care that each patient needs has increased significantly because of the rise in chronic conditions.

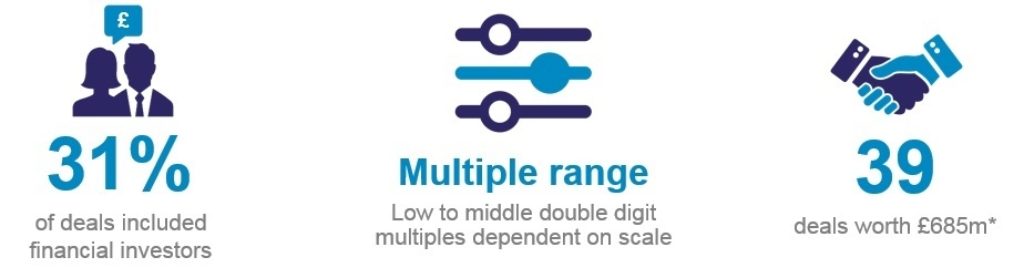

Care providers and investors realise the need to support the delivery of high-quality chronic disease management, increasing demand for specific types of care staff. Skills shortages and poor workforce planning by governments have led to rising agency costs. This in turn has caused consolidation in the market due to margin pressures on leading players as governments seek to cut costs in reducing agency use or by putting pressure on tariff fees.

Some agencies have specialised in order to protect margins, such as those which provide specialist nurses, surgeons or expert consultants.

Funding structures

In the UK, reform of the NHS has led to increased opportunities for private providers. Hospital trusts are increasingly looking to the private sector to provide cost-effective and efficient ways of delivering care.

In Germany 90% of the population is covered by statutory health insurance with the remainder privately insured. The introduction of diagnosis-related groups in 2004, a new pricing system for hospital services, has reduced public funding and privatisation of public facilities, therefore spurring consolidation in the hospital market.

Private funding now accounts for almost 30% of total health expenditure in Spain, while the private hospital sector has continued to consolidate. More than 90% of health funding is administered by its’ autonomous regions.

France is also seeing further growth in private provision and the Macron Government is expected to further reform the social care market.

Ireland has seen the development of many multi-speciality clinics, where people can access a range of healthcare services and providers. These can be attractive to investors given their long-term government backed leases and steady returns.

Alternative site care

The increasing use of telemedicine and mobile application devices means more patients are being treated via outpatient services or in their own homes.

There has been significant growth in the use of applications which enable patients to store their records and communicate directly with medical staff. Many of these applications operate on a subscription basis whereby a patient pays a monthly fee which allows them to input data onto the provider’s platform. For providers the strengthened ties to the applications and the repeat revenues from a subscription model can provide significant growth opportunities. Examples of this include Babylon Health and Push Dr who have both received investment in recent years.

Increased patient choice

With new technology and easier access to information, patients are increasingly aware of the healthcare choices available to them, and about where and how they can be treated. Government reforms have consistently sought to empower patients and promote the role of patient choice in improving services. Healthcare providers are having to adapt business models to meet this changing consumer behaviour.