Market analysis

Technological advances and regulatory change continue to bring challenges

As a recent report1 noted, it is difficult right now to point to any area of financial services which isn’t changing or under review. Although the Aegon report was talking about the UK asset management industry, it could have been talking about any market across Europe.

However, the UK is facing particular challenges. The Financial Advice Market Review (FAMR) continues to progress, while the Financial Conduct Authority (FCA) is starting to implement remedies from its major study of the asset management market. And, like the rest of Europe, the wide-reaching implications of EU regulations such as MiFID II, PRIIPs and the Insurance Distribution Directive are only now beginning to be felt.

UK leads the way

The UK asset management industry remains the largest in Europe and second largest in the world managing around £6.9tn (€7.9tn) of assets2. Over £1tn (€1.1tn) is managed for retail (individual) investors and £3tn (€3.4tn) on behalf of UK pension funds and other institutional investors. The industry also manages around £2.7tn (€3.1tn) for overseas clients.

The value of global AuM (Assets under Management) grew by 7% in 2016 to $69.1tn3 (€58.5tn) with the North American market, dominated by the US, remaining the world’s largest with 48% of global AuM.

Brexit

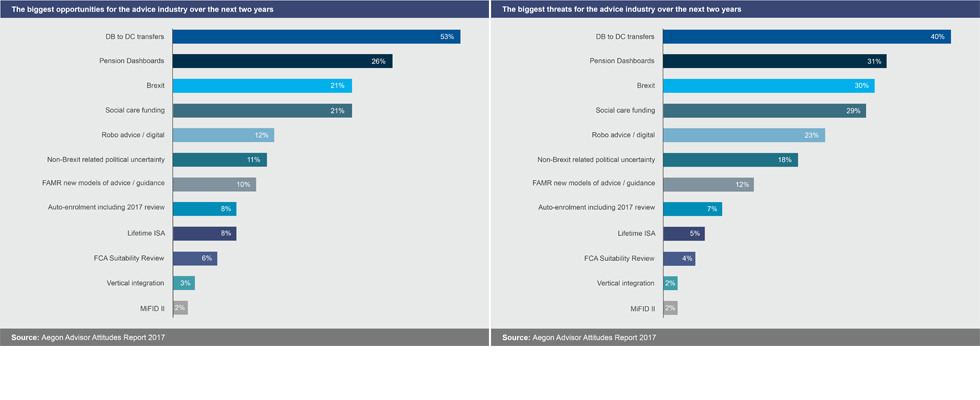

As the chart above shows, Brexit is a subject that divides not just the UK population, but financial advisers. Aegon found it a significant concern for two in five advisers who fear it could hurt their business prospects. However, conversely one in five believed that it could lead to new opportunities.

It added that in recent years the UK’s financial advice market, despite being buffeted by its fair share of regulatory headwinds, has emerged stronger and more sustainable. It says the adviser market is in rude health and the expectation is that this will continue for the foreseeable future. Four out of five financial advisers have seen their turnover increase over the past 12 months, and when asked to give their expectation for turnover over the next 12 months, the same number (81%) anticipate an increase, of which one in five are expecting a ‘significant increase’.

M&A activity

Against this backdrop there has been continued consolidation across the market, largely driven by regulatory changes such as MiFID II, that have placed a significant burden on smaller firms operating in the market. At the same time asset managers are under pressure from cheaper passively managed investment funds.

We have seen the emergence of a number of aggressive buy and build operations, most notably in the UK, typified by last year’s merger of Bellpenny and Ascot Lloyd. Other consolidators include the Succession Group, Mattioli Woods, AFH Financial, and Standard Life’s national advice firm 1825.

Looking ahead, the pressure to merge or sell for smaller firms will be hard to resist as they have less capability to handle the scale of business required to achieve a level of efficiency that is profitable in the current environment.

1: Aegon Advisor Attitudes Report 2017

2: Financial Conduct Authority – Asset Management Market Study June 17

3: The Boston Consulting Group – Global Asset Management 2017: The Innovator’s Advantage