18/11/2021 - Market news

Clearwater International secures top 10 European financial adviser position

Clearwater International completed 149 transactions worth €11.6bn (£9.8bn) across its M&A and debt advisory teams in the first three quarters of 2021, an increase of over 77% in deal volume compared to the same period in 2020. Of these, 121 transactions received Mergermarket M&A league table accreditation powering Clearwater into 8th position in the Mergermarket European Financial Advisors league table.

The Clearwater team in the UK were also delighted to win two awards during Q3 2021 including the prestigious UK Corporate Finance House of the Year award at The Private Equity Awards 2021 and the Large Business Corporate Finance Team of the Year award at the North West Insider Media Dealmaker Awards 2021.

Clearwater International in the UK completed 11 transactions worth over €490m

Clearwater International in the UK completed over 50 transactions worth more than €2.4bn (£2bn) in the first nine months of 2021. All sectors across the UK performed strongly in Q3 2021, with the Industrials & Chemicals, Healthcare and Debt Advisory teams all experiencing a particularly busy quarter, completing 11 transactions worth over €490m (over £410m). Highlights from Q3 include: advising the shareholders of Arran Isle, a leading designer, manufacturer and distributor of door and window hardware, on its sale to ASSA ABLOY, advising private equity investor Rutland Partners on the acquisition of market leading solutions provider within the packaging and e-commerce fulfilment sector, Southgate Global Limited and, advising mid-market private equity investor Livingbridge, on raising debt facilities to support the investment in North SP Group, a connectivity and IoT specialist.

The private equity community has had a very busy first nine months in 2021 and Clearwater has been heavily involved within this underlying activity working on both deployment and realisations.

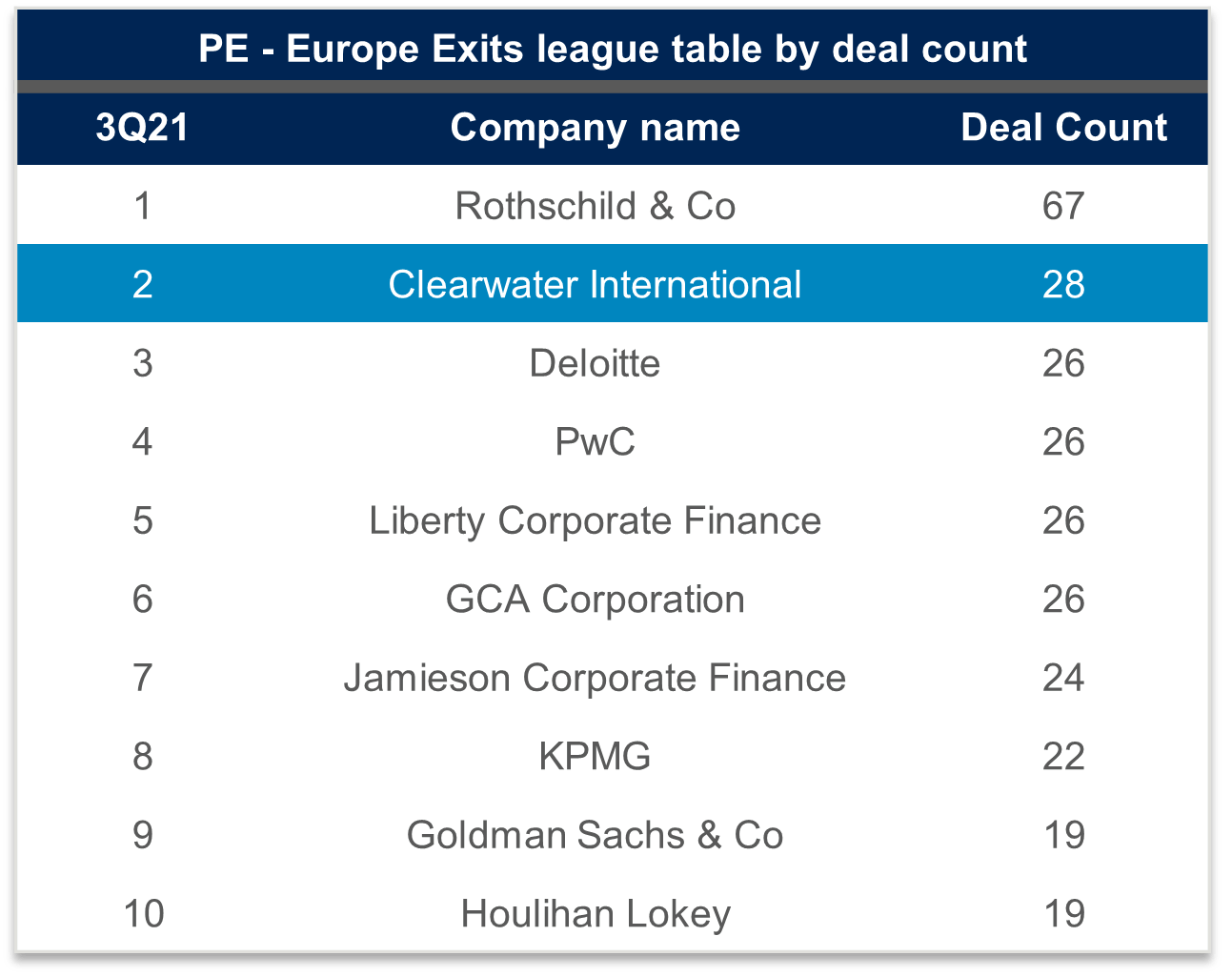

This has been recognised in league table terms with Clearwater ranking in 2nd place by number of PE exits worked upon. Similarly, Clearwater International has moved from 20th to 9th place by number of buy-outs advised upon.

Mark Taylor, UK Managing Partner, Clearwater International commented:

“I am delighted to see the team’s hard work recognised by key award wins within the industry, it has been an extremely busy period which looks set to continue. The most encouraging aspect is our client base continues to increase with our pipeline looking strong for the rest of 2021 and well into 2022.Our work with the private equity community continues to go from strength to strength and I am particularly proud of the breadth of service we are providing across our M&A, debt advisory and financial modelling capabilities.”