Seismic shift

Autonomous driving will revolutionise the automotive industry. It will reduce road accidents and deaths, cut traffic congestion, help tackle pollution, and increase productivity as drivers let technology take the strain.

For producers the developments in autonomous driving are upending the business models of OEMs as new entrants from the technology sector pour billions into the automotive industry, creating a seismic and long-lasting shift in the market.

Backed by very strong balance sheets, these new entrants are prepared to invest heavily in R&D – and talent – as they introduce a whole raft of new applications in vehicles. This poses a huge challenge for existing OEMs, not just in terms of trying to compete on R&D spend, but also in terms of where exactly to invest in the mobility revolution.

How much investment should go on autonomous driving? How much on electrification? And how much on connectivity solutions and shared mobility?

Which business models, especially in terms of mobility concepts, will emerge for OEMs and other stakeholders in a connected, autonomous driving world – and to what extent they will threaten or substitute today’s largely hardware-based revenue model of OEMs – is one of the key unanswered questions.

Integrated solution

Winners will be those players which are able to offer consumers – and successfully charge for it – maximum convenience in an integrated solution, combining low-to-zero emissions, autonomous driving, connectivity and smart mobility concepts.

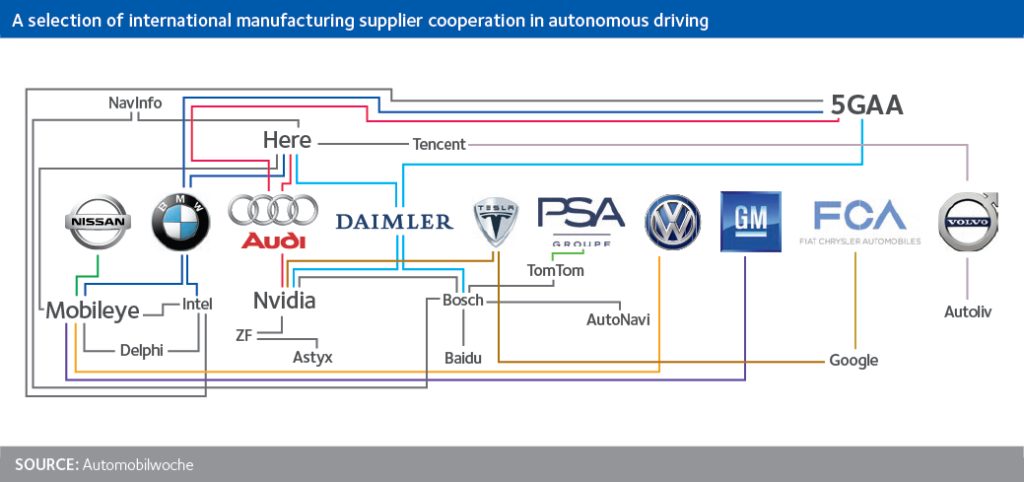

The winners could be an element of both old and new companies, as new tech entrants strike up relationships with established players in their rush to acquire new technical skills, a trend we have seen in the M&A space lately.

As a recent report1 noted, OEMs are now seeking solutions that integrate a “connected lifestyle with existing mobility solutions”. But competitors from the digital world are defining the problem and solution from the opposite direction, wanting to “integrate mobility with an existing connected lifestyle” that consumers already enjoy.

As another report2 notes, to deliver semi-autonomous and fully autonomous driving, the software used to determine a car’s position and trajectory on the road will have to deliver a new level of capability compared to current ADAS (Advanced Driver Assistance Software). The development of new radar systems and laser-based LiDAR (Light Detection and Ranging) scanning devices will be critical.

Timescales

Many across the industry believe that despite the huge technological advances we are seeing, regulations will ultimately set the pace of autonomous vehicle (AV) growth. For instance, when a passenger is not controlling a vehicle a key question is what happens if there is an accident. Who is responsible – the manufacturer, the software provider, or the passenger? Aligned to these tough questions there is also public scepticism. As such, the prevailing view is that fully autonomous cars are likely to remain a small-volume market for some time yet.

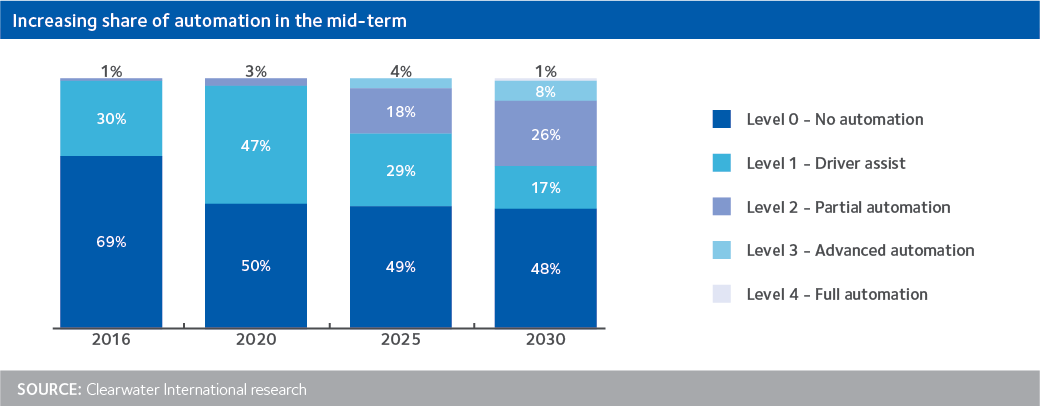

For at least the next decade most consumers are more likely to buy vehicles that use technology only to assist drivers, such as automated emergency braking or assistive parking, rather than fully autonomous cars.

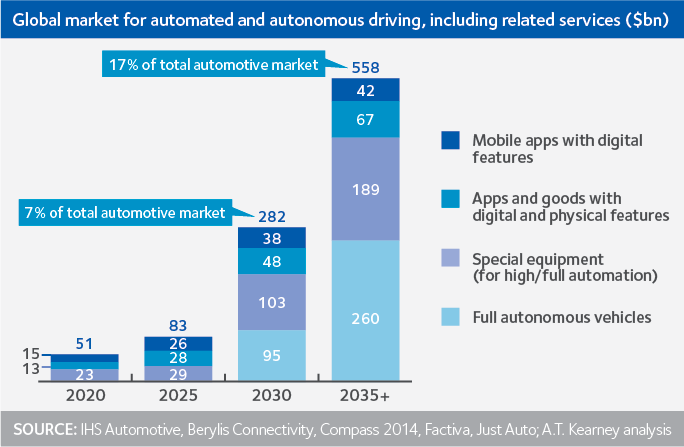

As the chart shows, the annual market for special equipment in AVs (on board control, guidance and communication systems) will reach $103bn (€83bn) by 2030, while the market for AVs will reach $95bn (€76bn) by that date1. The overall value of the market is expected to double to almost $560bn (€450bn) between 2030 and 2035.

IHS Automotive3 also recently revised its forecasts for AV sales upwards, forecasting nearly 76 million vehicles with some level of autonomy sold by 2035. It predicts particularly strong growth between 2025 and 2035, with sales of all AVs growing from just under 1 million units in 2026 to 21 million units in 2035.

Levels of autonomy

The gradual move towards AV is represented by many different levels of autonomy in a vehicle (see table below).

These range from scenarios where the driver is in complete control and there is no automation, through to one where the driver is not expected to be available for control at any time during the trip. Assessing the speed at which the industry moves up to higher levels will be crucial for leading players as they set out their strategies over the coming decades.

1: A.T. Kearney – How automakers can survive the self-driving era 2: Goldman Sachs – Monetising the rise of Autonomous Vehicles

3: IHS Automotive – Forecast October 2017