Legal Technology & Services

Scarica il pdf

The market is undergoing a paradigm shift as both law firms and in-house legal functions turn to technology vendors

The legal sector is a notorious laggard in technology adoption, a product of significant inertia amongst senior lawyers and a reluctance to implement costly changes to workflow, incentive structures, and fundamental operating models.

The COVID-19 pandemic has forced employees to work remotely which has further highlighted the shortcomings of current IT provision and has also shone a light on the disruptive and transformational potential of technology-led innovation.

The market is undergoing a paradigm shift as both law firms and in-house legal functions turn to technology vendors and alternative legal service providers (ALSPs) to reduce costs, refocus talent and innovate through leveraging technology and data.

Market Opportunities

The legal ecosystem is diverse and rapidly evolving with a number of new entrants and models. Its attractiveness is best highlighted by the significant investment the Big Four have been making in recent years to build out global legal practices to rival more traditional legal outsourcers. However, legal firms themselves have been reconfiguring their go to market strategies through either investing in legal start-ups, establishing technology incubators and partnering with or developing captive ALSPs.

The primary motivation for utilising an ALSP remains cost reduction, with traditional law firms under pressure from clients to demonstrate value for money at each stage of the process and corporates looking to refocus in-house legal resource away from routine compliance and low-value tasks to fulfil more strategic roles in corporate governance, business ethics, risk management and crisis management.

Technology is at the centre of the delivery model and acts as an enabler for ALSPs to move up the value chain to high-value services

This has contributed to ALSPs undertaking more complex and diverse workstreams. For example, in-house legal councils are now commonly outsourcing a broad suite of services, such as contract life cycle management, legal entity management and compliance, document review, due diligence, litigation and investigation support, and regulatory response work.

Technology is at the centre of the delivery model and acts as an enabler for ALSPs to move up the value chain to high-value services, whilst also further embedding themselves into client structures. Data collected and analysed can be used to provide business intelligence and efficiency insights, providing greater visibility andunderstanding of business risk exposure as well as client and team issues.

Its adoption is changing the structure of the legal profession and the evolution of the market is presenting attractive and scalable M&A opportunities across the value chain, from full-service tech- enabled legal services companies right through to pure-play software vendors.

Armstrong and Clearwater International have developed a market segmentation model which illustrates the potential entry-points for mid-market private equity (PE) and trade buyers to access a market which is poised for rapid change.

In more complex areas of law Artificial Intelligence (AI) and Natural Language Processing (NLP) will augment human expertise and drive massive efficiency improvements.

Technology ‘Stack’

The adoption of general-purpose cloud, cybersecurity, connectivity, and the use of collaboration platforms opens the door to improving back-office processes (e.g. modern HR, CRM, accounting, and billing systems) and driving efficiency through cloud-based core support systems with ‘consumerised’ interfaces and workflows (e.g. document, knowledge, and case management tools).

Human augmentation technologies which are replicating, supplementing and exceeding natural human abilities represent a significant opportunity in the legal sector. Robotic Process Automation (RPA) of repetitive or relatively low-skilled tasks will eventually commoditise entire areas of the legal provision (e.g. conveyancing and probate), whilst in more complex areas of law (e.g. corporate and litigation), Artificial Intelligence (AI) and Natural Language Processing (NLP) will augment human expertise and drive massive efficiency improvements.

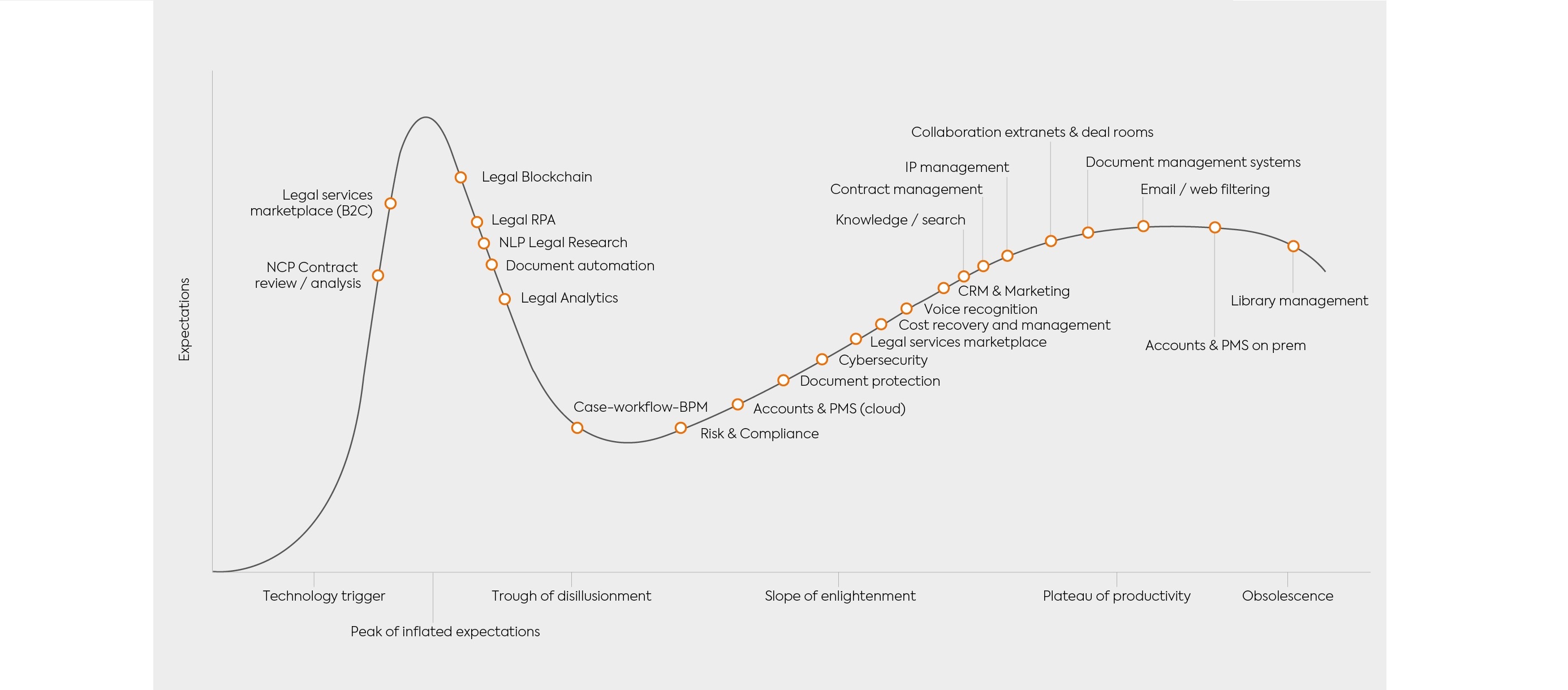

Legal ‘Hype Cycle’

The below graphic maps the key areas of legal technology and services to a ‘hype cycle’ as a proxy of market maturity and the associated risk profile. The technology areas at an earlier stage of the cycle (far left) tend to be best suited to investors with typically a higher risk appetite, although there are opportunities for mid-market PE to invest in companies that are transitioning from an advisory/ consultative model towards emerging technology. The more established technologies found in the ‘scope of enlightenment’ column are areas where PE has traditionally been active.