Market overview

Télécharger le PDF

Market segmentation

The dental market in the UK continues to be fragmented with 12,085 registered dental companies and 14,340 dental practices in total. 96.9% of dental companies employ fewer than 20 staff and on average, dental companies operate 1.18 practices each leaving considerable scope for consolidation¹. Significant opportunities exist for small and medium sized businesses to achieve strong returns through consolidation and growth.

Market size

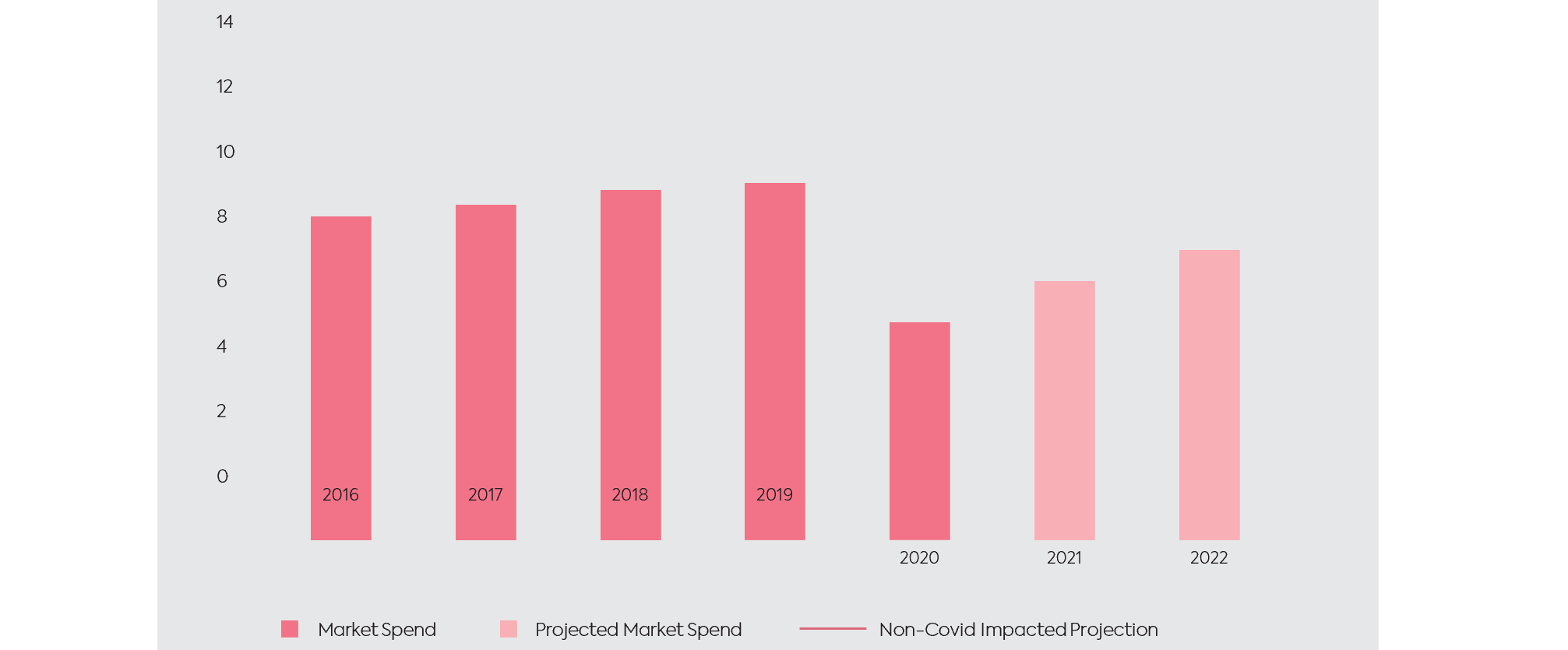

Expenditure on dental services is estimated to have been €8.2bn (£7.02bn) in 2020, down 31% from €11.6bn (£10.05bn) in 2019. The decline is due to the halting of almost all dental services for four months between March and July 2020 as part of the UK response to COVID-19. Prior to this, dental services expenditure had been increasing year-on-year, growing from €10.9bn (£9.35bn) in 2016 to €11.6bn (£10.05bn) in 2019, a cumulative annual growth rate of 2.4% per annum. As the economy recovers, a significant 15% increase in 2021 to €9.4bn (£8bn) is forecast as COVID-19 precautions look set to be mostly, if not fully, removed for the last quarter of the year.

As the market continues to recover in the way that it has done so far in 2021, a private sector bounce back to pre- COVID-19 levels is anticipated

The value of the dental market in 2020 was split almost equally between public and private sector, with the private sector being valued at €4.2bn (£3.6bn) compared to €4.1bn (£3.5bn) for NHS dental services.² This is in contrast to 2018, when private sector spend totalled €7.3bn (£6.2bn) compared to €4.6bn (£3.9bn) for the public sector. Contraction in sector spend is primarily due to the private sector.

As the market continues to recover in the way that it has done so far in 2021, a private sector bounce back to pre- COVID-19 levels is anticipated. Whilst the shape and length of this recovery is still difficult to determine, a “U” shaped recovery appears more likely than a “V”.

Size of Dental Market, 2016-2022

Source. Mintel, “UK Dentistry Market Report 2021”. 2021.

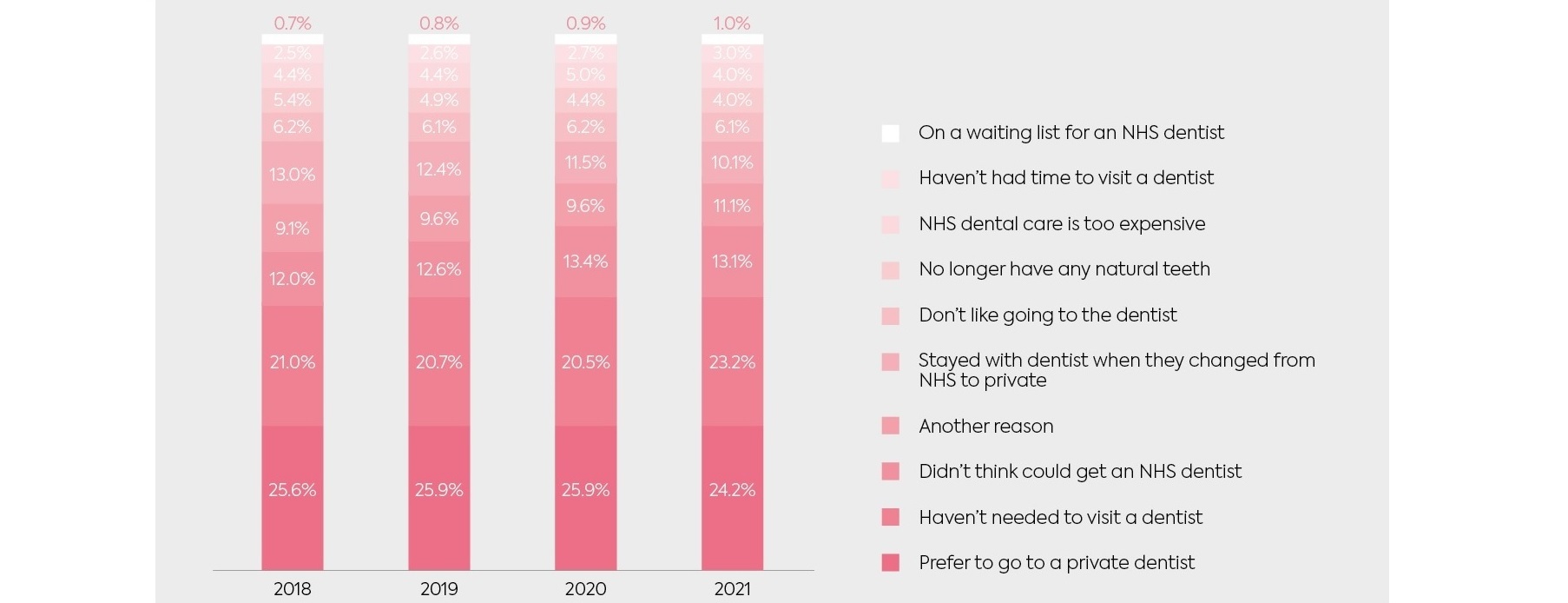

Though the value mix in the dental market shifted towards the public sector in 2020, this does not appear to reflect a shift in demand but rather reflects the persistence of NHS funding during an economic crisis. Results from NHS England’s most recent GP patient survey indicates that the proportion of respondents opting for private dental care instead of NHS care was largely consistent with the previous three years, lower by just 1.7%. GP patient survey data is taken between January and March meaning the 2020 responses are not impacted by COVID-19 suggesting that COVID-19 has not tangibly altered consumer attitudes towards dental care.

The total number of respondents opting for private medical care over public sits at just over a third (34.3%) when factoring in individuals that stayed with their existing dentist when they changed from public to private. This is down 3.1% from 37.4% in 2020.³

Proportion of respondents who did not try to get an NHS appointment in the last two years by reason for not trying, 2018-2021

Source. NHS England, “Summary of Dental Results”. 2021

COVID-19 implications

Due to the high aerosol environment present in the dental industry, the UK government imposed significant restrictions on the procedures that could be performed during Summer of 2020. The British Dental Association estimates that this resulted in 19 million appointments being delayed or cancelled in 2020 of an expected total of 40 million.⁴⁵

Long periods of no income generation affected practices disproportionally

Long periods of no income generation affected practices disproportionally, with those offering exclusively or higher levels of NHS services typically finding support easier to obtain as NHS payments largely continued at the usual rate with varying levels of reductions applied. Practices offering wholly private services or those with a heavy reliance on private service revenues had to rely on their eligibility for government support packages available to employers and business owners.

Of those private sector dental practices that applied to secure Coronavirus Business Interruption Loans, as many as 93.4% were unable to secure credit of which 46.7% reported being forced to secure other loans subject to commercial rates, further impacting the bottom line.⁶

In 2021, risk of insolvency remains low and continues to reduce as treatment volumes return to normal, but financial strain for many practices is still anticipated as governmental support is withdrawn creating further opportunities for large consolidators to make economical acquisitions.

Brexit implications

Whilst Brexit implications are pervasive across all sectors, the dental services sector has inherent protections due to strong customer preferences for local services, which limits the effectiveness of international competition. Whilst end-customer demand is unlikely to change due to Brexit, supply chains will be affected. Leaving the EU may create stagnation in certain supply chains and could lead to price increases ultimately adding to margin pressure. The longer-term impact of Brexit is still yet to be seen but dental businesses with more agility and economies of scale are likely to perform well through this next period and may have opportunities to make strategic acquisitions as a result.

Favourable demographics

The population of the UK continues to increase in size and age which supports a growing need for dental services in the UK. The population grew 0.5% between 2018 and 2019 to 66.8m and is anticipated to exceed 70m by 2031. The fastest growing age group within this is the over 65s who are anticipated to account

for 25% of the UK population by 2050 compared to 18% today.⁷

This growing age group requires higher volumes of remedial and restorative work when compared with younger groups as well as requiring more frequent check-ups. Continued increases in oral hygiene awareness is expected to drive growth across all age groups.

Cosmetic treatments

As cosmetic dental products become increasingly more affordable and visible to customers, demand for these products is only likely to increase

Cosmetic dental treatments offer a strong growth opportunity for the private dental sector as a market which is still largely untapped and could generate significant additional revenues from existing customers.

Growth in social media adoption has been linked to increased instances of body dissatisfaction, particularly in young people which appears to be driving awareness and adoption of surgical and non-surgical treatments in the UK.⁸ As cosmetic dental products become increasingly more affordable and visible to customers, demand for these products is only likely to increase. A 2020 parliamentary study found that 70% of UK adults had seen cosmetic dental adverts through social media compared to just 50% for non-dental cosmetic procedures. The same study found that as many as 28% of under 18s reported themselves and their friends considering cosmetic dental treatments compared to 15% for sunbeds.

Dental businesses like SmileDirectClub Inc have harnessed these trends. SmileDirectClub offers convenient, at-home teeth alignment products for comparatively low cost when compared with in practice solutions. The business leverages social media and social media influencers to promote its products which has facilitated revenue growth from $140m to $612m between 2017 and LTM-Mar 2021, a cumulative annual growth rate of 57.4%. Products requiring professional dental involvement remain highly popular as well with companies like Align Technologies Inc., creators of Invisalign, seeing revenues increase from $1.1bn in 2016 to $3.5bn in the LTM-Jun 2021, a cumulative annual growth rate of 29.6%.

Private equity

Private equity investors have continued to shape the top end of the dental sector

Private equity investors have continued to shape the top end of the dental sector with a majority of the largest corporate groups in the UK being private equity backed. Recent transactions indicate that this is unlikely to change in the near future. The highly scalable nature of dental services through regional expansion and the strong returns achievable from scaling makes the dental industry highly attractive to equity investors seeking a buy and build platform. The 10 largest dental groups have remained largely unchanged in the last 12 months although Damira Dental Studios have joined the list replacing Genix Healthcare. Together Dental also replaces The Dental Care Group as it is rebranded under G Square. Within the top eight, Dentex was the biggest mover, over taking Colosseum Dental as the latter targets other European markets for growth.

Top 10 UK dental groups based on number of practices, 2021