Private equity activity

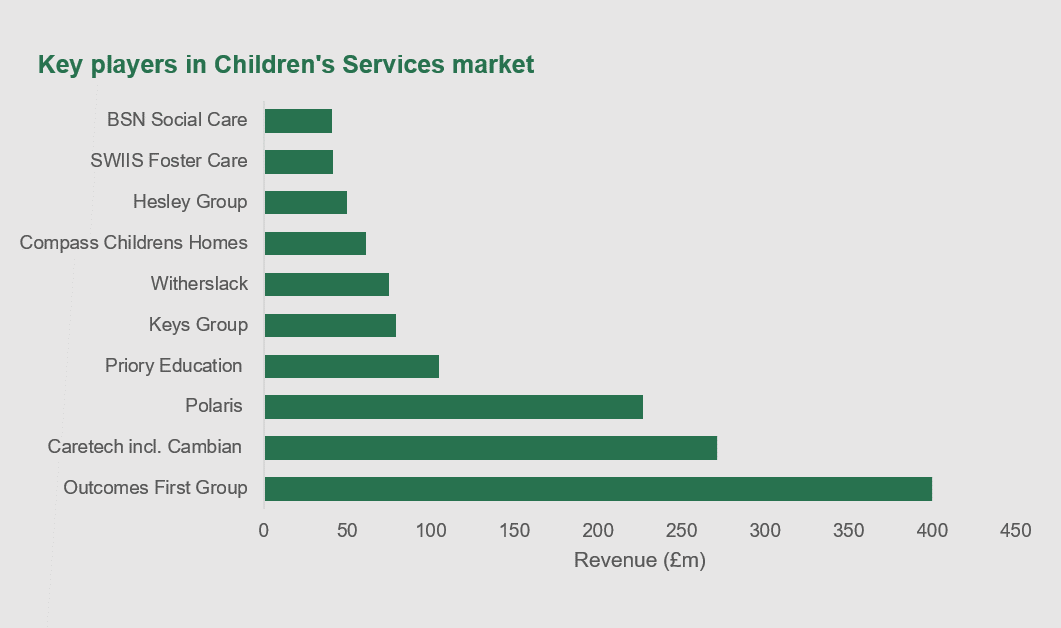

Télécharger le PDFPrivate equity has played a significant role in the consolidation of the children’s services market to date as owners look for opportunities to consolidate and build economies of scale, particularly in administration, recruitment and training. Four of the dominant groups that are currently private equity backed are Polaris, Outcomes First Group, Keys Group and Compass, to name a few. Investor interest shows no signs of abating and as they continue to search for children’s services companies with a strong management team and a platform fine-tuned for growth.

Notable recent UK deals:

- In July 2020, Bestport Private Equity sold Oracle Care and Education to an undisclosed acquirer. Headquartered in Congleton, Cheshire and Silsoe, Bedfordshire, Oracle provides high-quality bespoke packages of care, education and therapy for young people with extensive, complex and enduring needs who display high risk behaviours. The exit reportedly generated a 3.3x return for Bestport.

- In November 2019, Ardenton Capital acquired Pebbles Care, a provider of residential care and education for young people. Headquartered in Leeds and Dunfermline, Pebbles operates 41 residential care homes and four schools, providing care and education across the North of England and Scotland

- In October 2019, August Equity acquired Esland Care, a provider of residential childcare services based in the Midlands and the South East of England

- In August 2019, Graphite Capital led the management buy-out of Horizon Care and Education, a leading provider of specialist care for children and adolescents from NBGI. Horizon provides care for young people with Social, Emotional and Mental Health (SEMH) needs, managing 47 residential homes, 14 day schools and a range of supported living accommodation across England

- Sandcastle Care was acquired by Waterland Private Equity in January 2019. The business has been operating small care homes since 2004, and now offers long term residential care for vulnerable young people across 18 sites

- Graphite Capital invested in Compass Community in December 2017, a provider of fostering services, children’s residential care and schooling

- August Equity acquired Orbis Education & Care in June 2017 for a reported circa €31m (£28m). Established in 2005, Orbis operates seven specialist facilities for children and young people with autism and learning difficulties across Wales

- The largest independent fostering agency, The National Fostering Agency, which was founded by two social workers, was sold for circa €144m (£130m) in 2012 to Graphite Capital. It was sold again in 2015 to Stirling Square Capital Partners for an estimated circa €277m (£250m). The group has subsequently undertaken substantial M&A, including and has now been rebranded as the Outcomes First Group:

- Acquisition of Acorn Group, specialist provider of education and childcare services, from Teachers’ Private Capital (2016)

- Acquisition of Outcomes First Group, specialist provider of education and therapeutic care for children, for an undisclosed amount (2019)

Outcomes First Group continue to diversify its offering providing a full 'children’s care pathway' from foster care, residential care and specialist school and education services.

We see this type of diversification continue to develop in the short to medium term, as a way for independent children’s services providers to access more of the looked after children services/education budget.