Automotive Newsletter Q3 2022

Descargar PDF

Overview of M&A Activity

The conflict in Ukraine is still overshadowing all industrial sectors across the globe, in particular the European and American automotive industries, amidst their transformation process to become carbon neutral. Due to recession fears and a potential energy shortage, numerous vehicle manufacturers will face their second challenge with rising production costs, as well as ongoing uncertainties in the supply chain.

M&A activity remained constant in Q3 2022, compared to Q2

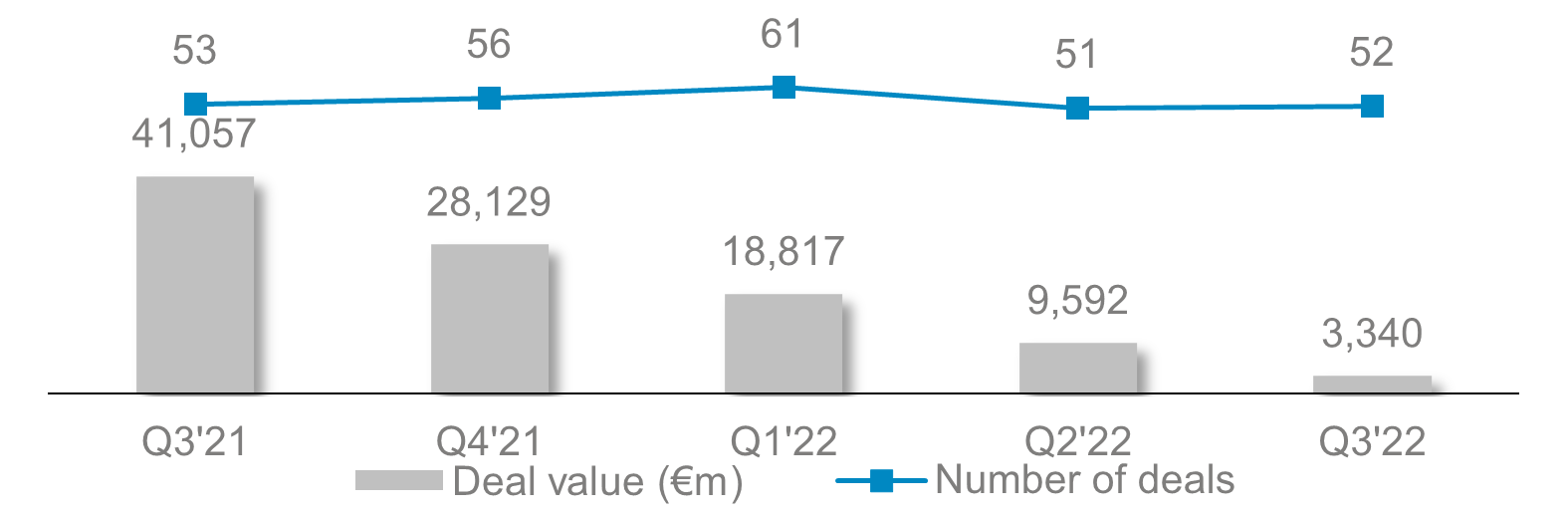

In terms of deal numbers, M&A activity remained constant in Q3 2022, compared to Q2. However, the cumulative deal value has decreased substantially in Q3 2022 (EUR 3.3bn), compared to Q3 2021 (EUR 41.1bn). Deals are still primarily driven by major trends, such as electromobility and connectivity with investments in companies like Bollinger Motors, Atlas Technologies and Orange EV, as well as special situations M&A, such as Henniges Automotive.

In contrast to this negative outlook, the valuation environment slightly improved in Q3 2022, compared to decreasing multiples in Q2 2022. In Europe, EV/sales multiples slightly decreased by 0.8%, whereas EV/EBITDA and EV/EBIT multiples increased, by 3.3% and 6.4% respectively in Q3 2022. This positive effect can also be observed in North America, where EV/sales, EV/EBITDA and EV/EBIT multiples increased by 0.4%, 3.9% and 0.9% respectively. However, in Asia, the valuation environment is exposed to a strong decline across all valuation multiples, with EV/sales, EV/EBITDA and EV/EBIT multiples decreasing by 6.4%, 4.7%, as well as 2.6% in Q3 2022, respectively.

ongoing transformation to electrify and digitise the sector is further driving the market

Although the automotive market is facing many difficulties and uncertainties in the current geopolitical environment, the ongoing transformation to electrify and digitise the transport sector is further driving the market across all regions, but the momentum is slowing down due to inflation, especially in Europe and the US. However, European auto parts makers will further face significant problems in production. This is due to possible energy shortages and continued semiconductor supply issues in the market, affecting the global supply chain in the upcoming months.

M&A Activity: Quarterly Comparison Q3 2021 – Q3 2022

Top M&A Deals Q3 2022

- Orange EV, the US-based heavy duty zero-emission truck maker, has received €35m in a founding round led by S2G Ventures and CCI. The investment will enable Orange EV to build its production capabilities to meet the increasing demand and to scale up the development of new technologies.

- Bollinger Motor, the US-based manufacturer and designer of electric sport utility and medium duty vehicle lines, was acquired with a 60% stake by Mullen Automotive, US-based company engaged in manufacturing electric vehicles. The transaction further enhances Bollinger’s ambitious plan to scale up innovation and allows a quicker speed of production.

- Atlas technologies, the Dutch-based manufacturer of solar vehicles, has received €81m from an investment consortium led by Invest-HL and DELA. The funds received will be used to build up sufficient production capacities that ensure production targets for this year and boost the development of new cars.

- ISOLITE, the German-based manufacturer of thermal insulations for automobiles, aircraft, and other industrial applications was acquired by Certina Automotive Products AG, a German-based industry holding company with a focus on European SMEs. The acquisition was part of a transition and strategic reorganisation process.

- Henniges Automotive, the German-based manufacturer of elastomer components for anti-vibration was acquired by private equity-backed, automotive buy & build company, Navigator Automotive Alliance. The transaction will enhance the financial situation of Henniges Automotive and will underline Navigator’s footprint in the automotive market.

Selected Recent Global Automotive Bond Issuances Q3 2022

| Company | Date of Issuance | Amount (in €m) | Coupon (in %) | Yield (Latest) | Price (Latest) | Maturity Date |

|---|---|---|---|---|---|---|

| Michelin | 23.09.2022 | n/a | 0.00% | 1.30% | 99.8 | 15.12.2022 |

| Knorr-Bremse | 21.09.2022 | 700.0 | 3.25% | 3.80% | 97.6 | 21.09.2027 |

| Continental | 05.09.2022 | 105.0 | 0.00% | 1.00% | 100.0 | 20.10.2022 |

| NSK | 05.09.2022 | 76.0 | 0.71% | 0.70% | 100.0 | 03.09.2032 |

Notes: 1) Deal value in Q3 2021 is driven by the Atieva/ Lucid Motors transaction (€23.5bn);

Sources: FACTSET, MergerMarket, Wirtschaftswoche, Ebner Stolz, S&P Global

Download the Q3 2022 Automotive Newsletter to read more about the market performance.