Healthcare assets

Market drivers

The residential care home market continues to see growth because of the ageing population whilst real estate investment trusts (REITs) are increasingly moving into healthcare markets, such as specialist care.

The Brexit vote and the resulting fall in the value of the pound, potentially makes healthcare assets in the UK attractive to overseas investors from a foreign exchange perspective.

Investment thesis

In the US there has been a heavy presence in the care home market from REITs for some years. These are now looking to invest in fragmented healthcare markets across Europe.

Infrastructure funds investing in companies are seeking to acquire long-term cashflow businesses with high quality freehold estates and high occupancy rates. For example, AMP Capital (Regard Partnership) and Impact Healthcare REIT have both made acquisitions in the space recently in mental health and learning difficulties, and special educational needs, respectively.

Infrastructure funds (IFs) have different hurdle rates and return models to traditional investor funds like private equity/sponsors who link their returns to a 3-5 year exit horizon. IFs have a longer horizon of 15+ years.

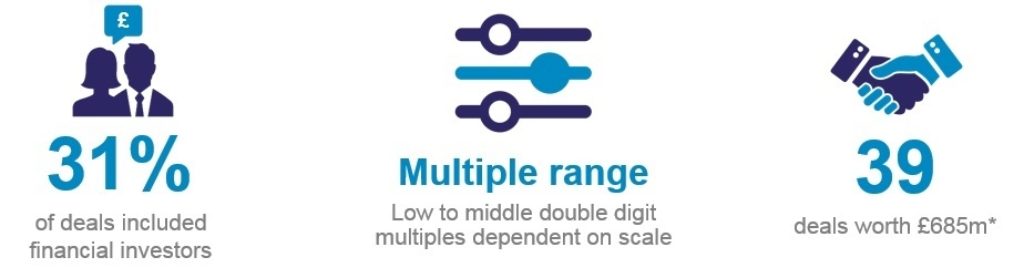

Trade activity

- Advinia Health Care Limited (UK) acquired 22 homes from BUPA (UK) - UK-based Advinia Health Care has increased its offering by adding a further 22 homes to its portfolio. Interestingly, BUPA still remains one of the biggest aged care providers in the UK with around 100 care homes, despite selling over 100 homes in 2017 to major rival HC-One. Like other large care home groups, BUPA has been looking to offload some of its portfolio as it grapples with cuts to government funding for the elderly.

EV: n.a, EBITDA: n.a - Korian SA (France) acquired CliniDom SAS (France) - Korian SA is a leading provider of care in France with around 740 facilities in operation currently. This deal strengthens Korian’s operations with a variety of different care solutions.

EV: n.a, EBITDA: n.a

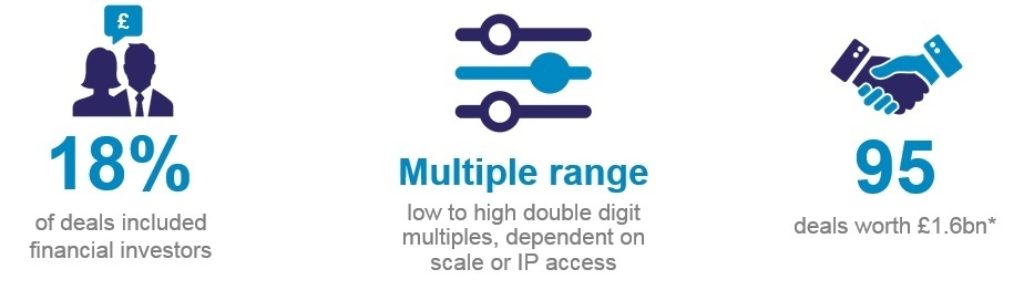

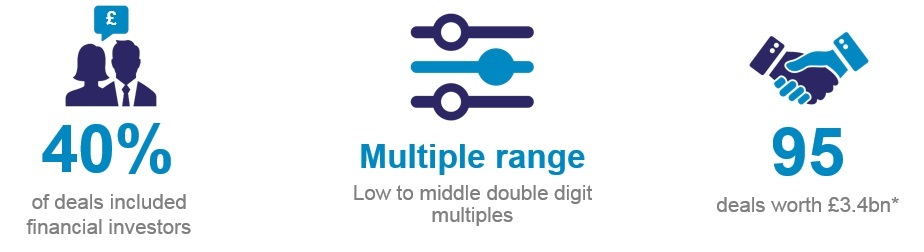

Financial investor activity

- Fremont Realty Capital (US) acquired Porthaven Care Homes (UK) - Porthaven comprises of 14 care homes and two development sites across England. During a six-year investment period with Phoenix Equity Partners, Porthaven has increased its number of homes five-fold through an organic rollout plan.

EV: n.a, EBITDA: n.a - Nordic Capital (Sweden) acquired Alloheim Senioren-Residenzen (Germany) - Alloheim is the second largest private German care home operator with 20,000 residents and was a pioneer in the German market opening its first home in 1973. Nordic Capital is an established healthcare investor and plans to invest further expanding the facilities and services offered by Alloheim.

EV: c.£968.1m, EBITDA: 12.5x - AMP Capital Partners (Australia) acquired The Regard Partnership (UK) - The Regard Group is the fourth-largest specialist care provider in the UK providing a range of services to those with learning disabilities and mental health needs including residential care, supported living, and day resource centres.

EV: c.£365m, EBITDA: 14.5x - Primonial Group (France) acquired a portfolio of healthcare properties (Germany) - Primonial Group is a French real estate investment management company. With this acquisition Primonial Group has acquired a 50% interest in a real estate portfolio in Germany of 71 healthcare assets, almost exclusively private rehab clinics, totalling 13,200 beds and spread over 13 federal states.

EV: c.£1.46bn, EBITDA: n.a

Sponsor backed platforms to note:

- Sponsor: Safanad Inc

Company: HC-One

Country: UK

Revenue: £375m

EBITDA: £55.3m

Invested: Nov 2014 - Sponsor: Duke Street

Company: Voyage Care

Country: UK

Revenue: £229m

EBITDA: £36.5m

Invested: Aug 2014 - Sponsor: OMERS

Company: Lifeways Community Care

Country: UK

Revenue: £230.1m

EBITDA: £19.6m

Invested: Jun 2012 - Sponsor: Stage Capital

Company: Horizon Care

Country: UK

Revenue: c.£21.4m

EBITDA: £2.3m

Invested: Feb 2012